ONE Group Hospitality (STKS)·Q3 2025 Earnings Summary

Executive Summary

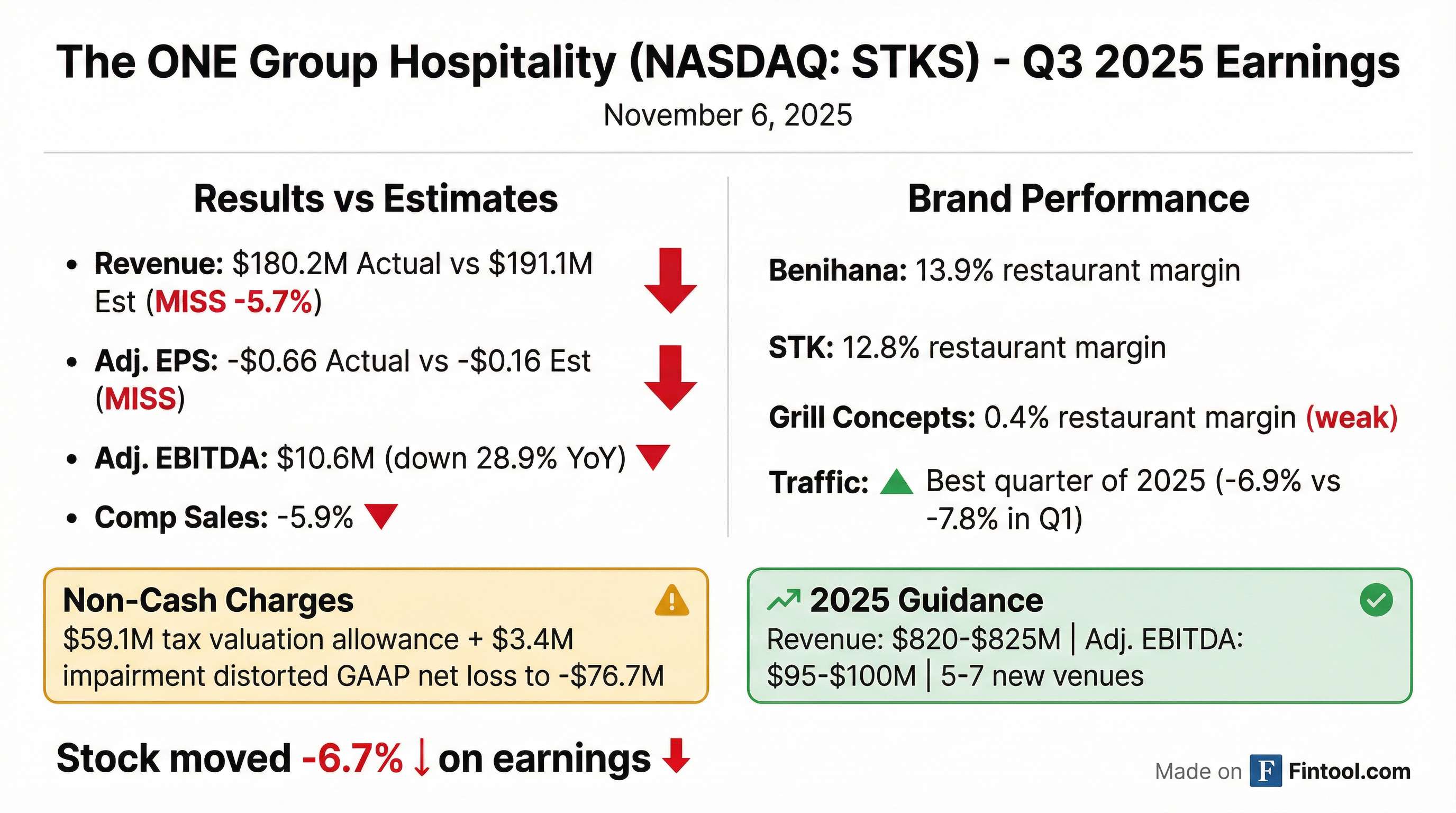

The ONE Group Hospitality (NASDAQ: STKS) reported a challenging Q3 2025 with revenue of $180.2M, missing consensus by 5.7%, and adjusted EBITDA of $10.6M (-28.9% YoY). Comp sales declined 5.9% driven by California market weakness and reduced pricing. Management lowered full-year guidance to $820-825M revenue (from $835-870M) and $95-100M EBITDA (from $95-115M). Stock fell 6.7% post-earnings.

Key takeaway: Sequential traffic improvement (best quarter of 2025) suggests stabilization, but geographic headwinds in California and macro pressures on target demographics continue to weigh on results. Portfolio optimization via Grill-to-STK/Benihana conversions underway.

Stock Performance & Earnings History

Financial Results

Q3 2025 vs Prior Year

*Net loss inflated by $59.1M non-cash tax valuation allowance and $3.4M impairment

Segment Performance

Same-Store Sales by Brand

Beat/Miss Analysis

Q3 2025 vs Consensus

Historical Beat/Miss Record (Last 8 Quarters)

Record: 2 beats, 6 misses in last 8 quarters

Guidance Changes

Full-Year 2025 Guidance (Lowered)

Management Commentary

What Went Wrong

"California was by far the most impacted of all markets in our portfolio. And the Benihana portfolio does have weight in the California market, some of our higher volume restaurants." — Manny Hilario, CEO

Key headwinds cited:

- California market weakness (-7 points sequential decline)

- Pricing lapped in August; effective pricing dropped from 7% to 4%

- Commodity cost inflation outpaced pricing adjustments

- Las Vegas convention calendar shifts

What Went Right

"Q3 2025 was our best traffic quarter for the whole year. We were down 6.9% in traffic for the third quarter, whereas in Q2 we were down 7.5%, and in Q1 we were down 7.8%." — Manny Hilario, CEO

Positives:

- Sequential traffic improvement (best quarter of 2025)

- Loyalty program momentum: 6.5M members, +200K in quarter

- San Mateo Benihana: highest-performing opening in brand's 60-year history

- First RA Sushi to STK conversion opened in Scottsdale

Strategic Initiatives

Portfolio Optimization

Management closed 6 underperforming Grill locations and identified up to 9 additional conversions to Benihana or STK formats by end of 2026

Conversion economics:

- Investment: ~$1M per conversion

- Timeline: 6-8 weeks

- Payback: ~1 year

- Average STK generates >$1M annual EBITDA

Q4 2025 Catalysts

- Pricing reinstated: 4.5-5.5 points weighted pricing effective November

- Holiday bookings strong: "Best November-December bookings since COVID"

- Benihana table turns: Targeting 90 minutes vs 120 minutes currently

- New openings: STK Oak Brook and Kona Grill San Antonio relocation

Q&A Highlights

On California Weakness

Q: What's driving the California weakness?

A: "Since the third quarter, we've seen some of that loosen up a little bit. But certainly in August and September, we saw a lot more pressure in our traffic in California, which is one of the reasons why we put the pause on our pricing actions."

On Benihana Comps Decline

Q: Why did Benihana comps decelerate?

A: "Benihana was the one that had five points of pricing that we did not replace in the quarter. So if I look at their differential in same-store sales, I would attribute it mostly to the pricing, not taking the pricing action."

On Franchise Pipeline

Q: Update on Benihana franchising?

A: "We have a deal that's almost done for some Benihana Express-type operations in California. And we also have a potential franchise deal for the Bay Area that's also shaping up."

Balance Sheet & Liquidity

*Values retrieved from S&P Global

Analyst Reactions

Consensus Rating: Hold (2 sell, 2 hold, 2 buy, 1 strong buy)

Price Targets:

- Average: $4.63-$5.05

- High: $6.00

- Low: $4.20

Post-Earnings Actions:

- Zacks lowered to "Strong Sell" from "Hold" on November 3

Historical Financial Trends

Management Tone Evolution

Q2 2025 (August 2025)

"We are pleased to have delivered results that met our expectations. We achieved strong top-line growth of 20%... Integration efforts following the Benihana acquisition are progressing ahead of schedule."

Tone: Cautiously optimistic, focused on integration synergies

Q3 2025 (November 2025)

"Our third-quarter performance was impacted by external factors that temporarily reduced traffic... These challenges created revenue headwinds. Additionally, rising commodity costs outpaced our pricing adjustments."

Tone: More defensive, acknowledging macro pressures, but highlighting execution improvements

Key Takeaways

-

Revenue miss driven by California weakness and pricing gap — Benihana comp decline directly tied to not rolling 5 points of pricing that lapsed in August

-

Traffic improving sequentially — Q3 was best traffic quarter of 2025, suggesting marketing and value initiatives gaining traction

-

Portfolio optimization accelerating — Up to 9 Grill conversions planned with attractive ROI (~$1M investment, 1-year payback)

-

Q4 set up better — Holiday bookings strong, pricing reinstated, table turn improvements at Benihana

-

Balance sheet manageable but tight — $45M liquidity, $637M net debt, no financial covenants triggered

-

Analyst sentiment bearish — Hold consensus, limited upside to price targets, Zacks downgrade